Heard about the "funding winter" making waves in the startup world? Well, after a dramatic decline in investments in 2023, it's true that raising funds for SaaS startups is getting tougher. Especially, in the middle for funding winter.

But don't panic just yet.

Let me tell you something: it's not all doom and gloom. In fact, this funding winter might just be the perfect time to launch your SaaS business.

Why?

Level playing field: Gone are the days when big players with big pockets used to dominate the scene, leaving little room for the little guys. But now it's a whole different ball game. Investors aren't just throwing money at flashy promises anymore. They want to see real results, real growth, real soon. And that is where you come in. This means that your scrappy startup has a fighting chance against the big players. But to make it, you need to be smart and adaptable. Here's how;

Strategies for navigating SaaS funding winter

1. Be efficient: save money with AI and no-code tools

Building a top-notch SaaS platform can drain your resources faster than you can say "venture capital." But with the use of Artificial Intelligence (AI) and no-code development platforms, you can automate tasks and build features without emptying your wallet.

Tips to get started

- Start by identifying tasks in your development process that can be automated or simplified using AI and no-code tools.

- Utilize platforms like Zapier or Safemailer to streamline workflows and reduce the need for extensive coding expertise.

- Leverage no-code development platforms like Fuzen to build features without extensive coding knowledge. This will help you cut costs and accelerate your product development.

- Consider investing in AI-powered analytics tools to optimize marketing campaigns and customer acquisition strategies, maximizing ROI while minimizing costs.

2. Get free stuff: use cloud perks

Cloud services can eat up a big chunk of your budget. But guess what? Big cloud providers like AWS, Google Cloud, and Microsoft Azure offer freebies for startups. Yup, they give you credits, training, and support to help your startup grow without burning through your cash. So, why not take advantage of that?

Tips to get started

- Research the startup programs offered by major cloud providers like AWS, Google Cloud, and Microsoft Azure.

- Sign up for their free tiers and take advantage of credits, training resources, and technical support to minimize upfront costs.

- Optimize your cloud usage by implementing cost-monitoring tools and scaling resources based on actual demand regularly to maximize the value of these free perks.

3. Prove your idea works: start small and win early

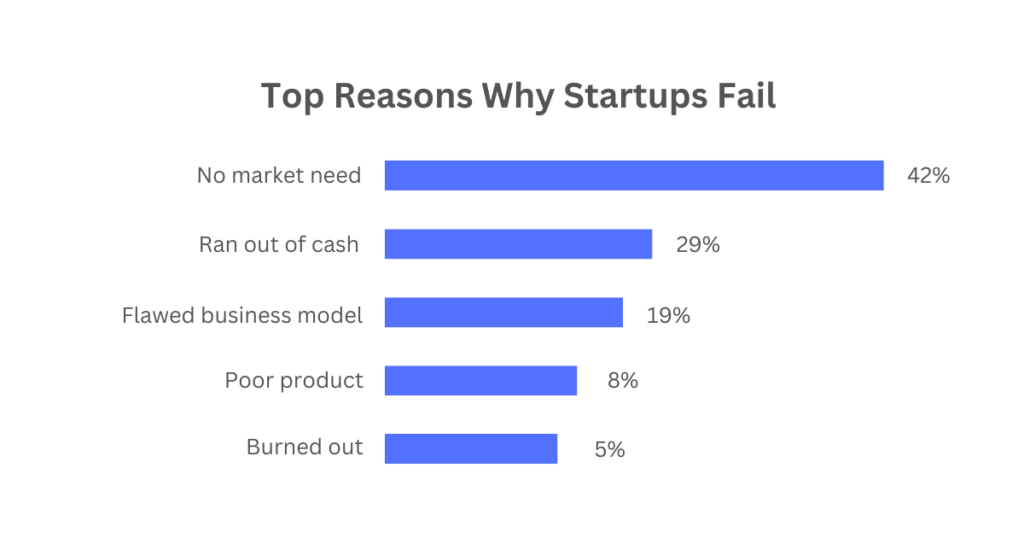

According to smart folks at CB Insights, 42% of startups fail because there's no market need. So, make sure people actually want what you're selling!

In fact, now Investors love seeing results. So instead of spending ages building something no one wants, start with a simple version of your product. It's called a minimum viable product (MVP). Focus on getting a few people to use it and love it.

Tips to get started

- Spend at least half of your time researching the market and deeply understanding your target customer’s problems.

- Develop a lean MVP focusing on core features that address the most critical pain points of your target audience. An easy-to-use no-code SaaS builder like Fuzen can help you here.

- Gather feedback from early adopters and iterate based on their input to refine your product.

- Utilize analytics tools to track user engagement and identify areas for improvement.

- Focus on acquiring paying customers as validation of your product-market fit, which will make your pitch more compelling to investors.

4. Focus on a specific group: find your niche

Trying to be everything to everyone is a recipe for disaster. Instead, zoom in on a specific niche within the SaaS market. Not only does it make your product more attractive to investors, but it also helps you keep your customer acquisition costs in check.

According to a report by McKinsey, companies that focus on niche markets are 33% more likely to outperform those that don't. It's like finding your tribe in a crowded room—it's easier to stand out when you're not lost in the crowd.

Tips to get started

- Conduct thorough market research to identify underserved niches within your industry.

- Define your ideal customer persona and tailor your product offerings to meet their specific needs.

- Develop targeted marketing strategies to reach your niche audience, such as leveraging social media groups or industry forums.

- Position your product as the solution to a niche problem, so that you can differentiate yourself from competitors and attract investors seeking high-growth opportunities.

5. Pick the right investors: find people who get you

Not all investors are created equal. Some might want you to sacrifice your firstborn for the sake of growth. But you don't have to play by their rules. Seek out investors who understand the SaaS game and share your vision for the future. They'll not only write you a check but also become your trusted partners on this wild ride. According to research by Harvard Business Review, startups backed by investors who provide hands-on support are three times more likely to succeed. So choose wisely—it's not just about the money, it's about finding the right fit for your startup's journey.

Tips to get started

- Take the time to research potential investors and assess their track record, industry expertise, and investment thesis.

- Look for investors who have experience in the SaaS space and understand the unique challenges and opportunities it presents.

- Build relationships with investors through networking events, pitch competitions, and warm introductions from mutual connections.

- When pitching to investors, emphasize your shared vision for the company's long-term growth and demonstrate how their support can add value beyond just financial backing.

Alternative sources beyond traditional venture capital investors

1. Angel Investors: High-net-worth individuals who provide capital in exchange for equity or convertible debt. Look for angel investors with domain expertise in SaaS who can offer valuable guidance and connections.

2. Crowdfunding: Platforms like Kickstarter or Indiegogo allow you to raise funds directly from a large number of individual backers. Crowdfunding can help validate your product and attract early adopters while maintaining control over your company.

3. Strategic partnerships: Forge strategic alliances with larger companies or industry players who can provide funding, distribution channels, or access to resources in exchange for equity or revenue-sharing agreements.

4. Accelerators and incubators: Join startup accelerators or incubator programs that offer funding, mentorship, and access to networks of investors and potential customers. These programs can provide valuable support in the early stages of your startup journey.

5. Revenue-based financing: Explore alternative financing models such as revenue-based financing, where investors provide capital in exchange for a percentage of future revenues. This can be a flexible financing option that aligns with your company's growth trajectory and revenue projections.

Conclusion

So, there you have it! The funding winter might seem scary, but with the right strategies, you can turn it into an advantage.

Remember, it's not about surviving the storm, it's about building a business that can handle anything. So, bundle up, use these tips, and get ready to conquer the SaaS world!