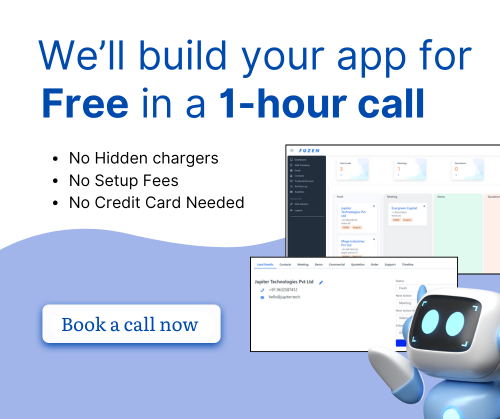

Small business owners wear many hats. They are the doers and the dreamers behind their ventures. But beyond passion lies a practical challenge that can’t be ignored: small business tax compliance challenges.

Why is it so tough?

- Limited resources: Unlike large companies, small businesses often lack a dedicated tax team.

- Constantly changing regulations: From income tax to GST, TDS, and payroll, staying updated feels like chasing a moving target.

- Multiple tax obligations: Each one demands time, accuracy, and deep understanding—luxuries most small business owners don’t have.

These pressures make compliance feel overwhelming. But understanding the common tax compliance challenges for small businesses is the first step toward solving them.

Common Tax Compliance Challenges Faced by Small Businesses

- Improper Record-Keeping

Many small businesses struggle with organizing their financial records. This inadequacy can lead to inaccuracies and gaps in documentation, making it difficult to provide proof for tax claims. - Missed Deadlines

Missing filing and payment deadlines can result in significant penalties and interest. These extra costs can severely impact a small business's budget and cash flow. - Classification Errors

Errors often occur in distinguishing between employees and contractors, or in categorizing expenses. These misclassifications can trigger audits or fines. - Lack of Professional Help

Due to budgetary constraints, small business owners may attempt to manage taxes on their own. This often leads to oversights and errors due to the complexity involved in tax regulations. - Confusion Over Deductible Expenses

Understanding which expenses can be deducted is complex. Confusion in this area might result in claiming incorrect deductions or missing out on legitimate ones, leading to issues with tax authorities.

These are some of the most common small business tax compliance challenges that can trip up even the most diligent entrepreneurs.

Actionable Tips and Tools for Overcoming Tax Compliance Challenges

- Adopting Cloud Accounting Software

Utilize tools like Xero or QuickBooks. These platforms streamline financial management and ensure better transparency. They can automate much of the accounting process, reducing the likelihood of errors related to small business tax compliance challenges. - Automated Reminders and Scheduling

Set up digital reminders for key tax deadlines. Use time management apps to stay on schedule, ensuring you never miss a filing date again. - Working with Tax Consultants

Invest in professional advice from tax consultants. Their expertise can prevent costly mistakes and ensure you take advantage of all possible deductions while navigating small business tax compliance. - Record Organization and Tracking Tools

Adopt simple tools or templates to maintain organized records. Properly track receipts, invoices, and other crucial financial documents to avoid common small business tax compliance issues.

Leveraging Fuzen's Custom CRM for Tax Compliance

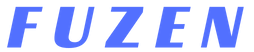

Managing tax compliance is one of the most persistent hurdles for small businesses. Fuzen’s no-code, AI-powered CRM offers a streamlined solution tailored for businesses that want flexibility, automation, and affordability—all without the need for technical expertise. Here's how Fuzen helps address small business tax compliance challenges:

- Automated Tax Workflow Reminders

Fuzen lets you set automated reminders for GST filings, income tax submissions, TDS payments, and more, helping avoid costly penalties due to missed deadlines. - Digital Invoice & Receipt Tracking

Effortlessly upload and store all your invoices and receipts in one place. Fuzen helps maintain audit-ready documentation, minimizing the risk of non-compliance. - Custom Client & Vendor Records

Organize your financial ecosystem by tracking transactions, payments, and communication history with both clients and vendors, crucial for year-end tax reporting. - Cost-Effective Pricing

Unlike traditional accounting CRMs, Fuzen charges only a one-time app development fee plus minimal hosting costs. This eliminates recurring subscriptions—a major advantage for small businesses on a budget. - No-Code, Easy Setup

You don’t need to be tech-savvy. Fuzen's drag-and-drop interface and AI-assisted customization allow you to build your tax workflow CRM with zero coding skills. - Scalable as You Grow

As your business expands, Fuzen can adapt, supporting multi-user access, increased record volumes, and more advanced tax management processes. - Built-in Compliance Support

Easily log records, tag deductible expenses, and document tax-related workflows, making it easier to stay compliant during audits or financial reviews.

Fuzen provides small businesses with the tools they need to simplify and solve small business tax compliance challenges. It’s an intuitive, cost-effective, and scalable solution that grows with your needs, empowering business owners to focus more on building and less on bookkeeping.

Conclusion

Maintaining tax compliance is crucial for the longevity and success of any small business. Navigating small business tax compliance challenges becomes far more manageable when equipped with the right tools and strategies. From cloud accounting software to automated scheduling—and most importantly, leveraging Fuzen’s custom CRM, business owners can streamline their compliance efforts with confidence.

By implementing these solutions, small businesses can reduce errors, meet deadlines, and focus more on growth rather than paperwork.

Take proactive steps today - get started with Fuzen and simplify your tax compliance with a no-code CRM built for small business success.

Pushkar is a seasoned SaaS entrepreneur. A graduate from IIT Bombay, Pushkar has been building and scaling SaaS / micro SaaS ventures since early 2010s. When he witnesses the struggle of non technical micro SaaS entrepreneurs first hand, he decided to build Fuzen as a nocode solution to help these micro SaaS builders.