Investing in real estate can be tough due to complex regulations, security issues, and the need for investor education. A Real Estate Crowdfunding Platform tackles these challenges by allowing individuals to pool their resources for property investments.

This platform simplifies the process and offers essential educational tools, making real estate investment more accessible.

Whether you're just starting out or scaling your portfolio, it's essential to understand how such tools fit into the broader real estate industry. Let’s explore everything you need to know.

Market Research

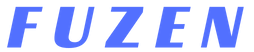

The real estate crowdfunding market has been growing fast. By 2026, it’s expected to be a multi-billion-dollar industry worldwide.

- In the U.S. alone, the alternative finance market, which includes real estate crowdfunding, was worth over $17 billion in 2020.

To get a realistic view, consider:

- Real estate is a highly attractive investment.

- Both investors and property developers are key users.

With steady growth and more people trusting crowdfunding platforms, a new platform could aim to capture around 1-2% of this market. This means a potential target market of $170 million to $340 million annually.

Ideal Customer Profiles (ICPs)

Here’s who you should focus on:

- Individual Investors: People looking to diversify their investments into real estate. Millennials are a great target since they’re familiar with online investing.

- Property Developers: Small to medium-sized developers who need funding without relying on traditional banks.

- Financial Advisors: Advisors looking to offer clients new ways to invest.

- Retail Investors: People with $5,000 to $50,000 to invest, who want alternatives to stocks.

Beachhead Market

Your best starting point is individual investors, especially millennials. Here’s why:

- They’re comfortable with technology and online platforms.

- They’re actively looking for new ways to diversify their portfolios.

- Digital marketing makes it easy to reach and engage with them.

Focusing on this group first helps build a strong foundation before expanding to other markets.

Competitive Landscape

Let's get a clear sense of who the main players are, what they’re doing right, and where there might be room for you to make a difference.

Top Competitors

| Platform | Strengths | Weaknesses |

|---|---|---|

| Fundrise | - Well-known brand with a solid reputation. - Low minimum investment ($10). - User-friendly app with transparent fees. - Offers diverse investment options, including eREITs. | - Limited liquidity for investors needing quick cash. - Few options for overseas investments. |

| RealtyMogul | - Variety of investment types (individual properties and REITs). - Strong due diligence process for property selection. | - Higher investment minimums. - Some investments are only open to accredited investors. |

| CrowdStreet | - Tailored for accredited investors looking for commercial real estate deals. - Offers a detailed marketplace and rich educational resources. | - High minimum investments may exclude beginners. - Complex platform, which could be overwhelming for newcomers. |

| DiversyFund | - No fees for investors. - Focus on long-term growth by reinvesting profits into properties. - Provides solid educational content. | - Limited to one investment option (growth REIT). - Not enough diversification, which may not suit all investors. |

| Groundfloor | - Focus on debt investments with low minimums ($10). - Open to non-accredited investors. - Short-term real estate loans available. | - Higher risk due to debt investments. - Lower returns compared to some equity investments. |

Opportunities for Your Platform

Here are a few ways you can differentiate your platform from the competition:

- Inclusivity: Make the platform open to both accredited and non-accredited investors, with competitive minimum investment amounts.

- Liquidity: Consider offering more liquidity options, like a secondary market where users can buy or sell shares in active projects.

- Transparency and Education: Build trust with clear fee structures and provide educational content to help users feel confident in their investments.

- User Experience: Focus on an easy-to-use interface with simple navigation and strong customer support.

Prudent Feature Set

Here are some features that can help set your platform apart:

- Simulated Investments: Offer a virtual tool where users can practice investing without risk, similar to a stock market simulator.

- Community and Networking Tools: Allow investors to interact, share advice, and learn from each other.

- Mobile App: Develop a mobile app that sends push notifications about updates and new investment opportunities.

Potential Pricing Strategy

You’ll need a competitive pricing strategy to attract users:

- Investor Fees: Keep fees around 0.5% to 2% annually. You could also offer discounts or incentives for early users.

- Developer Fees: Aim for 1% to 3%, with incentives for early-stage projects or partnerships.

Basic Plan

$10-$20

/month

Ideal for beginner investors

who are new to real estate crowdfunding and need

essential tools to start

building their portfolios.

Professional Plan

$50-$100

/month

Ideal for experienced investors seeking advanced analytics, detailed portfolio insights,

and priority support to enhance their investment strategies.

Enterprise Plan

$250-$500

/month

Ideal for high-net-worth individuals and institutional

clients looking for exclusive opportunities, and dedicated account management for investing

GTM Strategy for Your Real Estate Crowdfunding Platform

Let’s craft a GTM strategy to attract individual investors, particularly millennials, to your Real Estate Crowdfunding Platform. Here's how you can secure your first 100 customers

| Marketing Strategy | Approach | Speed | Cost |

|---|---|---|---|

| 1. Content Marketing | Create educational content like blog posts, eBooks, webinars, and infographics to simplify real estate investing. Use SEO for keywords like "real estate investment for beginners". | Medium | Low (in-house) / $500 to $2,000 (outsourcing) |

| 2. Social Media Marketing | Share success stories and investment opportunities on Instagram, Twitter, and LinkedIn. Use explainer videos, testimonials, and Q&A sessions. | Fast | Low to Medium (ads: $500 - $1,500) |

| 3. Partnerships and Influencer Collaborations | Partner with finance podcasters, bloggers, and YouTubers. Offer referral bonuses or exclusive platform access. | Medium | Medium ($1,000 - $5,000) |

| 4. Online Communities and Forums | Engage in Reddit forums and finance platforms. Provide value by answering questions and hosting AMAs. | Medium to Fast | Low (time and effort) |

| 5. Email Marketing | Build an email list with a free guide and nurture leads through regular emails with insights and market updates. | Medium | Low to Medium (tools under $100/month) |

Tech Stack Expert for Building a Real Estate Crowdfunding Platform

Building your Real Estate Crowdfunding Platform with Fuzen is a fantastic idea. Here’s how you can make it happen using a no-code approach.

Key Features to Consider

- User Registration and Profile Management:

Let users sign up as investors or developers. Keep profiles secure with login and personal info management. - Investment Listings:

Add property investment options with details like location, terms, and expected returns. - Investment Tracking:

Let investors track their investments and returns with dashboards showing performance and history. - Payment Processing:

Integrate secure payment gateways like Stripe or PayPal for transactions. - Communication Tools:

Allow messaging between investors and developers. Share updates and reports easily. - Regulatory Compliance:

Include KYC verification and manage documentation digitally for legal compliance.

Building with Fuzen

- Database Management:

Fuzen makes it easy to store and manage user and investment data securely. - Workflow Automation:

Automate processes like user verification, email notifications, and investment updates. - Dashboard and Reporting:

Fuzen can integrate with data visualization tools to create dashboards and track key metrics. - Integration:

Fuzen allows flexible integration with third-party services like payment gateways, communication platforms, and customer support tools.

Potential Cost Savings

Using Fuzen and a no-code approach can save you up to 80% on development costs. With Fuzen, you don’t need a big team or months of coding. A small team, or even a single user, can get the basic framework up and running quickly.

Conclusion

With Fuzen, you can launch your MVP (Minimum Viable Product) fast. Focus on core features, collect user feedback, and adapt quickly. This not only saves you money but helps you stay flexible and responsive to users' needs.