Real estate accounting is essential in a dynamic industry with constantly changing financial landscapes. For real estate professionals, keeping a close eye on finances is vital. From managing commissions to tracking expenses, precise financial tracking is a necessity. This not only ensures accurate earnings but also allows for effective financial forecasting.

Real estate transactions involve multiple parties, which means numerous transactions and expenses. This complexity highlights the need for a CRM checklist app. It helps professionals understand cash flows, maintain budgets, and make strategic decisions. Without it, real estate professionals may struggle to manage their financial health effectively.

Commissions can vary greatly, depending on the property's value and the terms of the sale. Expense management ensures that every dollar spent is accounted for, reducing waste and maximizing profit. Financial forecasting, on the other hand, relies on key CRM features that allow real estate professionals to predict future trends. It helps them prepare for market changes and seize opportunities.

In essence, real estate accounting isn't just about numbers. It's an integral part of managing a successful real estate business. It supports growth, enhances profitability, and provides a solid foundation for business decisions.

Challenges of Using Separate Systems for CRM and Accounting

Data Duplication Increases Risk of Errors

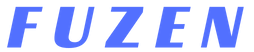

Real estate accounting becomes increasingly complex when agents rely on separate systems for CRM and accounting. One major issue is the duplication of data. With siloed systems, agents must manually input the same information in both CRM and accounting platforms, which increases the risk of errors.

Missed Invoices Disrupt Cash Flow

Missed invoices are another common problem. Separate systems can lead to oversights where invoices aren't generated or sent on time. This delay might impact cash flow and client relations, creating stress for agents trying to manage finances efficiently.

Reporting Inaccuracies Complicate Decision-Making

Reporting inaccuracies can further complicate matters. When data is spread across multiple systems, compiling accurate reports becomes a challenge. Agents might find themselves struggling with mismatched figures and incomplete data, which can skew their understanding of business performance.

Manual Oversight Leads to Costly Errors

Imagine a scenario where an agent closes a deal but forgets to update the accounting software due to manual oversight. Later, during financial reconciliation, the absence of this entry causes confusion and requires extra effort to fix. Such situations can waste valuable time and resources.

These challenges show why a unified real estate accounting system integrated with CRM is essential. It reduces manual work, ensures accuracy, and improves financial visibility—allowing agents to focus on growing their business instead of fixing backend issues.

Integrating Real Estate CRM with Accounting Tools

Integrating real estate CRM systems with accounting tools like QuickBooks, Xero, or Zoho Books can significantly streamline operations. One of the major advantages of this integration is automated commission calculations. Automated systems ensure that commission percentages and final amounts are calculated accurately, leaving no room for manual errors.

Another beneficial feature is expense synchronization. By linking CRM and accounting tools, all incurred expenses are automatically tracked and logged. This saves time and ensures accuracy, allowing agents to focus more on client interactions rather than financial administration.

Real estate accounting becomes far more efficient with integration, as real-time report generation becomes a standout feature. With a seamless flow of data between CRM and accounting tools, professionals can generate comprehensive reports on demand. These reports provide up-to-the-minute insights into sales performance, expense management, and financial health.

Integration facilitates a smooth and continuous data flow between systems. This reduces the need for repetitive manual data entry, minimizing errors and saving valuable time. For example, when an agent closes a deal, the CRM automatically updates the accounting tool. This integration ensures consistency and reliability across all financial records.

Overall, integrating open-source CRMs with accounting tools simplifies complex processes. It transforms real estate accounting into a more efficient, accurate, and holistic operation, ultimately supporting real estate professionals in better managing their business.

Key Benefits of CRM and Accounting Integration

- Improved Cash Flow Tracking: Integration provides real-time visibility into cash flow. It helps real estate professionals track income and expenses more accurately, ensuring a better understanding of their financial status.

- Faster and More Accurate Invoicing: By automating the invoicing process, integration ensures that invoices are generated and sent promptly. This reduces delays in payments and helps maintain a steady cash inflow.

- Reduced Manual Errors: With data flowing seamlessly between CRM and accounting software, the need for manual data entry is minimized. This significantly reduces the risk of errors and discrepancies in financial records.

- Enhanced Decision-Making Capabilities: Integrated systems offer comprehensive reports and insights, enabling professionals to make informed decisions quickly. By having access to holistic data, agents can plan strategically for growth and development.

For instance, a real estate agency that integrated their CRM with QuickBooks reported a 30% reduction in accounting errors and a 25% improvement in invoice processing time. Such data demonstrate the tangible benefits of integration.

In summary, integrating CRM and accounting software brings clarity and efficiency to financial management. It empowers real estate professionals to operate their businesses more effectively and make better, data-driven decisions.

Introducing Fuzen: Your No-Code Solution

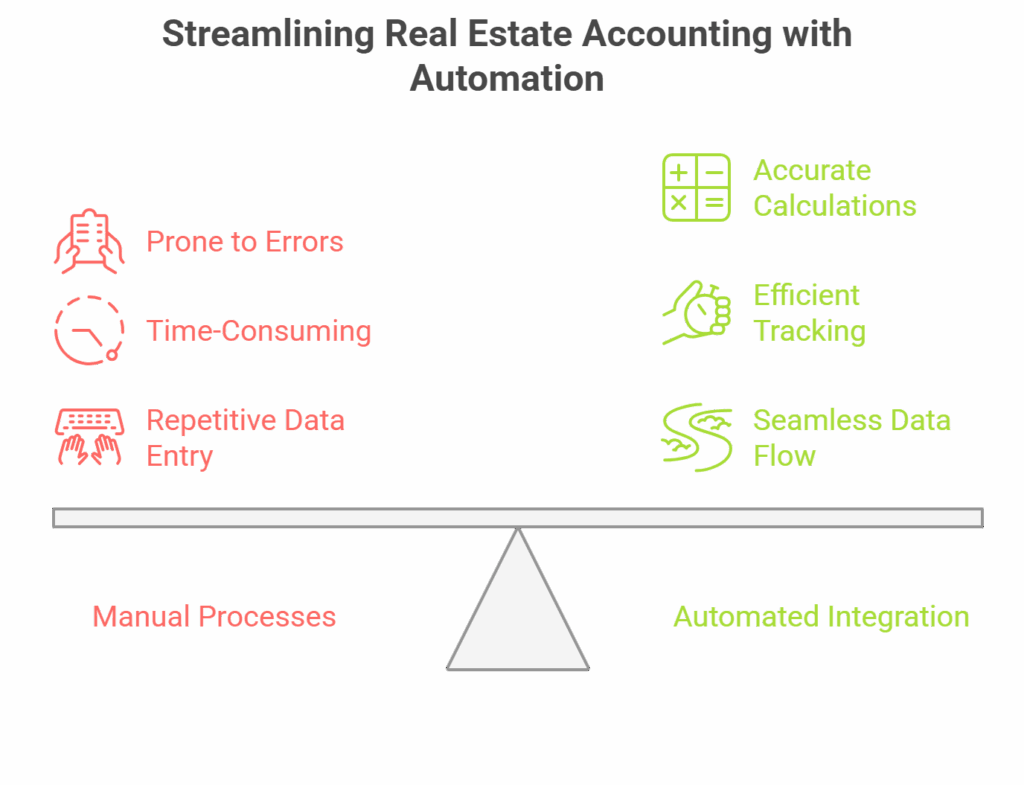

Fuzen is an ideal platform for real estate professionals looking to integrate their CRM with accounting software, all without needing any coding skills. With Fuzen's no-code tools, you can create fully customized CRM solutions tailored to your unique business needs.

Fuzen connects effortlessly with leading accounting tools like QuickBooks, Xero, and Zoho Books. This integration ensures a seamless flow of data between your CRM and accounting systems, bringing efficiency and accuracy to your real estate accounting processes.

One of Fuzen’s standout features is its cost-effectiveness. Unlike other platforms that charge hefty development fees, Fuzen only requires users to pay for hosting. This means you can develop and maintain your applications at minimal cost, or even free.

Additionally, apps built on Fuzen are Real Estate Marketplace Services App With No Code scalable. Whether your business is expanding or adjusting to market changes, Fuzen's code editors make it easy to add new features and functionalities without hassle. Plus, maintaining these apps is straightforward with Fuzen’s intuitive no-code tools.

Overall, Fuzen provides a powerful, flexible, and affordable solution for real estate professionals wanting to streamline their operations through CRM and accounting integration.

Conclusion

In the real estate industry, maintaining financial accuracy and streamlined processes is crucial for success. Integrating CRM systems with accounting tools can eliminate inefficiencies, reduce errors, and enhance decision-making capabilities in real estate accounting.

By choosing a no-code solution like Fuzen, real estate professionals can effortlessly integrate their CRM with accounting software. This ensures smooth, efficient, and error-free financial management. Consider Fuzen for its cost-effective and scalable platform, which can transform your office operations.

Don't miss the opportunity to enhance your business processes with integrated solutions. Take the next step towards improving your financial tracking and overall business performance by exploring this CRM platform built for real estate operations.

Pushkar is a seasoned SaaS entrepreneur. A graduate from IIT Bombay, Pushkar has been building and scaling SaaS / micro SaaS ventures since early 2010s. When he witnesses the struggle of non technical micro SaaS entrepreneurs first hand, he decided to build Fuzen as a nocode solution to help these micro SaaS builders.