Liability insurance isn't just a nice-to-have for home service businesses; it's a necessity. Imagine running a window installation business and accidentally breaking a client's expensive vase. Or what if a team member gets injured on the job? These situations can lead to costly claims and lawsuits.

Liability insurance acts as a shield. It protects your business from financial strain due to unexpected mishaps. Without it, you risk losing money, harming your reputation, or, worst case, shutting down.

Having the right insurance can mean the difference between a thriving business and one on the brink of closure. It ensures your assets are safe and helps you focus on what you do best—providing excellent service. In this blog, we'll explore why liability insurance is so crucial and how you can secure it for your business's longevity.

Understanding Liability Insurance For Home Service Businesses

Liability insurance is a type of coverage that provides financial protection for businesses when they face claims or lawsuits. It's like a safety net for unexpected problems that could otherwise drain your finances.

Think of it as a shield that stands between your business and costly legal battles. If a customer slips and falls or if something goes wrong during a service call, liability insurance helps cover expenses associated with these incidents.

Having such insurance is crucial for maintaining stability. It ensures that unexpected incidents don't lead to significant financial loss. More importantly, it safeguards your business's reputation by showing clients that you’re prepared and responsible.

Without insurance, a single lawsuit could hurt your reputation and lead to financial difficulties. With it, you have peace of mind knowing your business is protected against unforeseen challenges.

Common Risks Faced by Home Service Providers

Home service providers, like electricians or cleaners, face several risks daily. Let's break down a few common ones:

- Property Damage: Imagine accidentally damaging a client's furniture while cleaning. Such mishaps can lead to expensive repairs or replacements.

- Personal Injury: An employee might slip and injure themselves while working in a client's home. This can result in medical expenses and workers’ compensation claims.

- Service-Related Liabilities: If a service doesn't go as planned, a client could sue for financial losses or damages incurred.

These risks can lead to significant financial stress. This is where liability insurance steps in. It offers a buffer, covering costs that might otherwise fall directly on your business. With insurance, you can manage these situations without emptying your bank account.

Insurance is not just about protecting against financial loss; it's also an investment in your business's reliability and reputation. By ensuring you're covered, you show clients your commitment to handling issues professionally and responsibly.

Types of Liability Insurance For Home Service Businesses to Consider

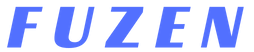

When it comes to protecting your home service business, different types of liability insurance can serve specific needs. Here's a look at a few key options

- General Liability Insurance:

This is the most basic type of liability insurance, covering common incidents like property damage and personal injury. For example, if a customer's property is damaged during a service call, this insurance helps cover the costs. It's essential for most home service businesses as it offers broad protection against everyday risks.

- Professional Liability Insurance:

Also known as Errors and Omissions (E&O) insurance, this covers claims related to the professional services you provide. If a client alleges that your service didn't meet expected standards or caused them financial loss, this insurance helps. It's particularly important for businesses offering expert services like consulting or specialized advice.

- Product Liability Insurance:

If you manufacture or sell products, this insurance covers you in case a client claim injury or damage from a product you supplied. Imagine selling cleaning products that cause damage to a customer’s property, product liability insurance would help cover the costs.

Each type of insurance offers specific benefits and is suitable for different scenarios. Evaluate your business needs to determine which types best protect against potential risks you might face.

Steps to Obtain Liability Insurance

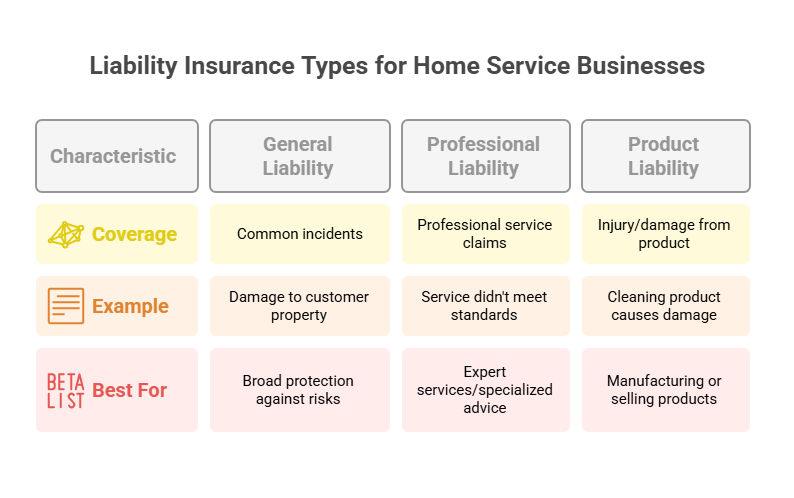

Getting liability insurance for your home service business doesn’t have to be complicated. Follow these steps to secure the right coverage

- Assess Your Risks: Start by assessing the specific risks your business faces. Consider factors like the type of services you offer and the environment in which you operate. Understanding these risks helps determine the coverage you need.

- Research Insurance Providers: Look for insurance companies that specialize in coverage for businesses like yours. Seek recommendations or customer reviews to gauge their reliability and service quality.

- Compare Quotes: Get quotes from multiple providers to find the best value. Pay attention not only to the price but also to what each policy covers. Ensure the coverage aligns with your risk assessment.

- Determine Coverage Options: Decide on the types of liability insurance you need—general liability, professional liability, and/or product liability. Tailor the coverage limits and exclusions to your specific business needs.

- Review Policy Details: Before purchasing, thoroughly review the policy details, including terms, conditions, and any potential exclusions. Ensure you understand what is covered and what is not.

- Purchase the Policy: Once satisfied with the terms, proceed to purchase the policy. Keep all relevant documents organized for easy access.

Following these steps helps ensure that your business is adequately covered by liability insurance, cushioning against unforeseen challenges and financial losses.

Coverage Options and Considerations

When choosing liability insurance for your home service business, it's important to understand the different coverage options available. Let's explore these options, focusing on limits and exclusions.

- Coverage Limits: These are the maximum amounts your insurance will pay for a claim. Assess your business size and risks to choose adequate limits. Avoid being underinsured, which could leave you struggling to cover costs beyond what's insured.

Policy Exclusions: Every insurance policy has exclusions—situations not covered by your plan. Understand these exclusions thoroughly. Ensure they don’t leave gaps in essential protection areas for your business.

Choosing the Right Options: Consider the nature of your services and potential liabilities. Tailor coverage to bridge gaps while avoiding excess coverage that inflates costs unnecessarily.

Periodic Review: Regularly review and adjust your policy. As your business grows, ensure your coverage evolves to match new risks and opportunities.

By carefully considering coverage limits and exclusions, you can tailor your insurance policy to provide optimal protection. This balance ensures your business remains secure without overspending on unnecessary coverage.

Managing Liability Insurance with a CRM

Using a home service business CRM system to manage your liability insurance can streamline operations and enhance efficiency. Here’s how a CRM helps in managing insurance policies effectively:

Document Storage: A CRM provides centralized storage for all insurance documents. This makes it easy to access policy details and maintain records securely.

Renewal Date Tracking: Never miss a renewal date. A CRM helps track important dates related to your policies, ensuring they remain valid and up to date.

Automated Reminders: Set automated reminders for tasks like policy renewals or reviews. This feature ensures you take timely actions without manual intervention.

Here are some best practices for keeping insurance details up to date within a CRM system:

- Regularly update records with any changes in insurance terms or coverage.

- Use CRM tags or folders to categorize policies based on type and provider for easy retrieval.

- Periodically audit CRM data for accuracy and completeness.

By leveraging CRM features, businesses can efficiently manage their liability insurance, ensuring comprehensive protection and seamless operation.

Integrating Insurance Data and Ensuring Compliance

Integrating insurance data within a CRM system is vital for maintaining compliance and smooth business operations. Here's why it matters and how it benefits your home service business:

- Centralized Data Management: Having all your insurance data in one place simplifies management. It provides easy access to policy details, coverage limits, and renewal dates, which is crucial for staying compliant with industry regulations.

Streamlined Operations: Organized records help streamline workflows. This efficiency is especially important before dispatching technicians, ensuring they have the necessary insurance coverage for each job.

Enhanced Accountability: Integrating insurance data into your CRM enhances accountability. It ensures that both management and field staff are aware of coverage details, reducing the risk of oversight and errors.

By integrating insurance data into your CRM, you maintain compliance and ensure all service dispatches are covered by appropriate insurance, protecting your business from potential liabilities.

CRMs Supporting Insurance Management

Choosing the right CRM can make insurance management a breeze for home service businesses. Here are some CRMs known for their insurance management capabilities, focusing on automation and ease of use:

- HubSpot CRM: Offers automation features for managing insurance documents, reminders, and renewals. It's user-friendly and integrates well with other tools, enhancing operational efficiency.

Zoho CRM: Provides customizable insurance tracking and automated workflows. It's scalable, making it suitable for growing businesses needing robust insurance management.

Fuzen CRM: Fuzen takes it a step further by enabling custom insurance tracking modules. It's designed to be affordable, helping businesses cut costs while enhancing efficiency through streamlined insurance management.

Fuzen stands out by offering customizable options tailored specifically to insurance needs. Its strong integration with AI allows for adjustments using simple prompts, offering a cost-effective solution for businesses seeking comprehensive insurance tracking without breaking the bank

Conclusion

Liability insurance is a critical safety net for home service businesses, shielding against unexpected claims and financial losses. As we've discussed, understanding the types of insurance and how to obtain them is essential for protecting your business. Integrating tools like CRMs further streamlines management, ensuring coverage and compliance are always maintained.

By proactively managing insurance policies, business owners can focus on delivering quality services without the fear of unforeseen liabilities. This not only safeguards your operations but also secures your business's future, fostering growth and stability.

Pushkar is a seasoned SaaS entrepreneur. A graduate from IIT Bombay, Pushkar has been building and scaling SaaS / micro SaaS ventures since early 2010s. When he witnesses the struggle of non technical micro SaaS entrepreneurs first hand, he decided to build Fuzen as a nocode solution to help these micro SaaS builders.