E-commerce PCI compliance is more important than ever in today’s digital environment. A recent finding shows that nearly all leading U.S. retailers, over 95%, have faced data breaches involving third-party vendors within the last year. This underlines just how vulnerable payment systems can be.

Securing online transactions is not just a back-end requirement. It plays a direct role in shaping how much trust customers place in your store. When people input their credit or debit card details, they expect that information to remain protected. Without strong safeguards, customer confidence quickly erodes.

If a shopper senses insecurity, they’re unlikely to complete the transaction. A single breach can result in a loss of trust, costly legal issues, and steep fines. As online shopping expands, so does the responsibility to manage sensitive payment data with care.

That’s exactly why e-commerce PCI compliance matters. It sets the standards businesses need to follow to protect cardholder data and maintain trust. By staying compliant, you’re not just protecting customer details—you’re protecting your business in a fast-moving digital world.

Understanding E-commerce PCI Compliance

E-commerce PCI compliance is essential for any online business handling card payments. At the core of this compliance is PCI DSS, short for Payment Card Industry Data Security Standard, a set of security guidelines created to protect credit and debit card transactions.

For e-commerce businesses, adhering to PCI DSS is more than just meeting legal requirements. It ensures financial data stays secure and builds long-term trust with customers. When customers feel confident in your payment system, they are more likely to complete transactions and return for future purchases.

Businesses that maintain e-commerce PCI compliance demonstrate a clear commitment to data security. This transparency helps reassure customers that their sensitive information is handled responsibly.

However, failing to follow PCI standards can result in serious consequences. A data breach could expose customer information, damage your brand reputation, and result in significant financial penalties or legal action. The long-term impact on customer loyalty can be devastating.

In short, e-commerce PCI compliance is not just a regulatory checkbox. It's a smart, proactive business decision that protects your customers, enhances your credibility, and secures your financial operations.

Key Components of PCI Compliance for E-commerce

PCI DSS compliance involves several crucial components that e-commerce businesses need to understand and implement. Let's explore some key requirements specifically relevant to the online selling industry.

- Maintaining a Secure Network: E-commerce sites must have robust firewalls and security measures to protect cardholder data from external threats. Regular updates and security patches should always be a part of the security routine.

- Protecting Cardholder Data: Encrypt sensitive data during transmission and storage to make it secure. Data encryption ensures that even if cybercriminals access the data, they cannot read it without the encryption keys.

- Implementing Strong Access Control Measures: Limit access to credit card information to only authorized personnel. Use multi-factor authentication and strong passwords to enhance security.

- Regularly Monitoring and Testing Networks: Regularly audit and monitor your network's security systems. Conduct vulnerability assessments and penetration testing to identify and resolve potential security weaknesses.

E-commerce sites can meet these requirements by collaborating with trusted partners and technology providers who specialize in payment security. Additionally, staying updated with PCI DSS regulatory changes and investing in employee training on security best practices will further enhance compliance efforts.

Role of E-commerce CRMs in Supporting PCI Compliance

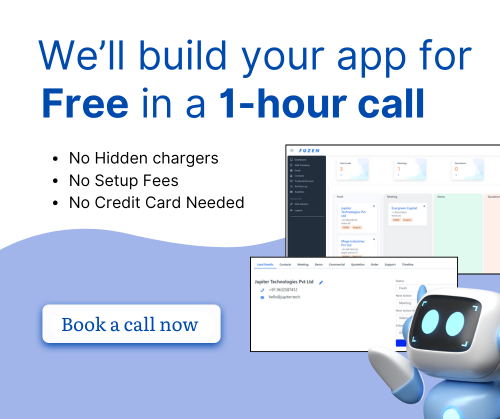

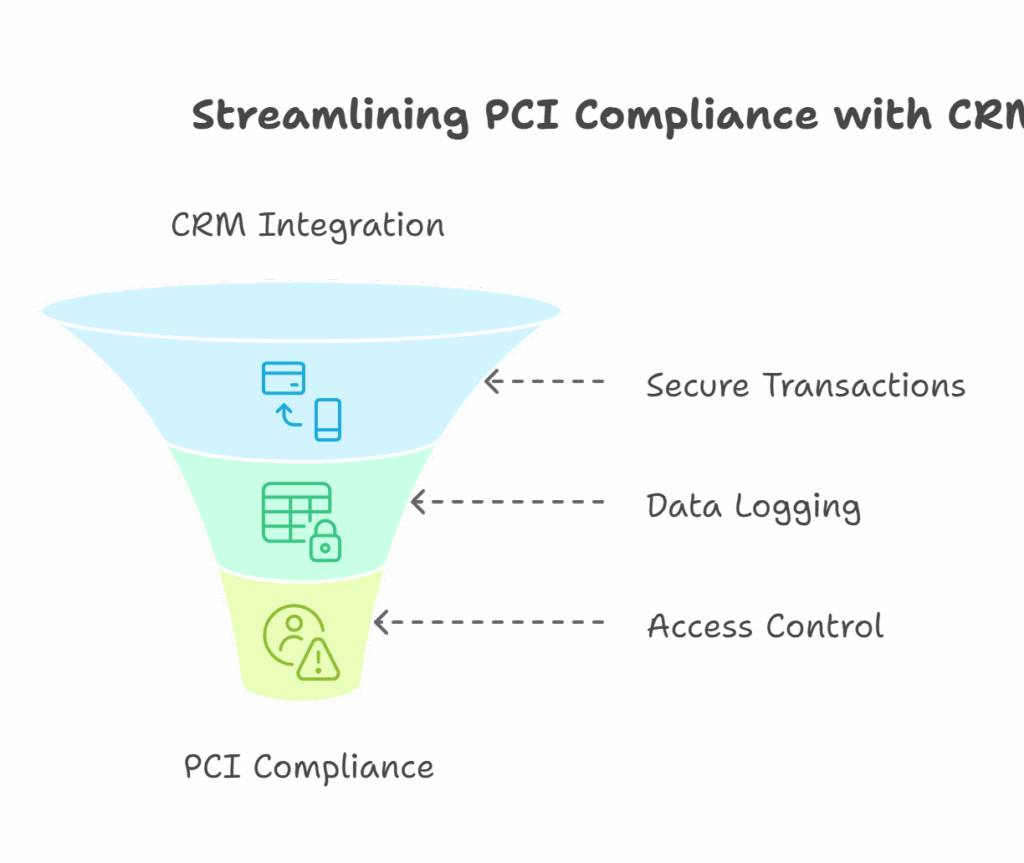

E-commerce Customer Relationship Management (CRM) systems play a vital role in achieving e-commerce PCI compliance. These systems offer tools and features that support secure online transactions and help businesses align with PCI standards effectively.

Firstly, CRMs can seamlessly integrate with trusted payment gateways. This ensures all transactions are processed securely and comply with PCI DSS requirements. By linking with reliable payment services, CRMs help reduce risks and strengthen payment security.

Additionally, e-commerce CRMs offer secure transaction history logging. They enable businesses to track and manage payment data while maintaining data integrity and confidentiality. This functionality is essential for audits and for identifying any suspicious activity early on.

Limiting access to sensitive customer data is another key feature of CRM systems. CRMs enforce role-based permissions, ensuring that only authorized personnel can access critical information. This protects against internal threats and reduces the chances of a data breach.

In summary, CRM systems simplify e-commerce PCI compliance by automating security processes and supporting robust data protection practices. They provide the essential infrastructure needed for safe data handling and regulatory compliance.

Building a Secure E-commerce Environment with Fuzen

Fuzen offers a robust solution for building a CRM that integrates seamlessly with secure payment systems, supporting full e-commerce PCI compliance. For online businesses, this ensures that every customer transaction is protected by design, reducing risks and building trust.

One of the standout features of Fuzen is its cost-effective, one-time hosting model. Unlike traditional platforms that require recurring monthly fees, Fuzen allows users to develop and deploy CRMs at a custom cost without hidden charges. This makes PCI-compliant CRM development accessible even for small and mid-sized businesses.

Key advantages of using Fuzen for e-commerce PCI compliance:

- No-code development tools: Anyone can build or customize a CRM without writing a single line of code. Fuzen’s drag-and-drop interface makes setup simple and intuitive.

- AI-powered customization: Users can describe workflows or features in plain language, and Fuzen's AI builds them into your CRM. This simplifies automation, access control, and secure payment flows.

- Workflow management templates: Fuzen provides pre-built CRM templates tailored to e-commerce needs, including customer data handling, transaction logs, and permissions, all optimized for PCI compliance.

- Scalability and flexibility: As your business grows, so can your CRM. Fuzen supports real-time updates, multi-user access, and integrations with payment gateways and marketing tools.

- Secure architecture: Fuzen’s infrastructure is designed with compliance in mind, helping you maintain encrypted data flows, user authentication, and access controls—all key components of PCI DSS.

Fuzen is more than just a CRM builder — it’s a no-code SaaS platform that enables you to create secure, scalable, and regulation-ready applications tailored to your unique business needs. By using Fuzen, you not only meet e-commerce PCI compliance requirements but also gain the flexibility to adapt and grow without technical complexity or financial strain.

Conclusion

Ensuring e-commerce PCI compliance is no longer optional—it’s essential for maintaining customer trust and protecting sensitive payment information. From secure transaction processing to data access control, every detail matters when it comes to compliance.

With Fuzen’s no-code platform, achieving PCI compliance becomes both accessible and affordable. You can build a tailored CRM solution that integrates securely with payment gateways, automates compliance workflows, and scales with your business. Fuzen’s AI-assisted customization, one-time hosting model, and user-friendly tools make it the ideal choice for e-commerce businesses that want full control over security without the cost or complexity of traditional platforms.

By choosing Fuzen, you’re not just checking off compliance boxes—you’re laying the foundation for a secure, scalable, and customer-trusted e-commerce operation.

Pushkar is a seasoned SaaS entrepreneur. A graduate from IIT Bombay, Pushkar has been building and scaling SaaS / micro SaaS ventures since early 2010s. When he witnesses the struggle of non technical micro SaaS entrepreneurs first hand, he decided to build Fuzen as a nocode solution to help these micro SaaS builders.